One Thing We Never Travel Without (Travel Medical Insurance)

Hey there, dear Hoppers! We have been asked many times if there is one thing we would not travel without.

The answer is simple, Travel Medical Insurance.

It’s more than just a practicality; it’s a peace-of-mind essential. It’s become a non-negotiable item on our packing list – an understated but indispensable companion for the unpredictable journey of life on the road. Travel, with its unpredictability, can throw curveballs, and having medical coverage ensures we’re not left stranded in unfamiliar territory. It’s a quiet assurance that, if things take an unexpected turn, we’re not alone and trust us, unfortunately, we know something about this.. read this blog article if you did not know about our moto accident in Vietnam.

It’s mind-boggling that many travellers embark on journeys without the safety net of travel insurance. The unpredictability of life on the road makes it a wild ride, and not having insurance is like navigating uncharted territory without a map (and how can you hop on the map, without a map??!!).

The notion of invincibility can be particularly strong among digital nomads, fueled by a sense of self-sufficiency and a belief that they can handle whatever comes their way. The reality is, accidents, big and small, can happen at any time. That’s why it’s crazy not to have travel insurance, how can you enjoy travelling without peace of mind? Why be in gamble mode? Travel smart, travel safe, and let the reassurance of travel medical insurance accompany you on your journeys. What we always say is: If you have money to travel, you also have money to purchase travel medical insurance.

But Which One Do We Have?

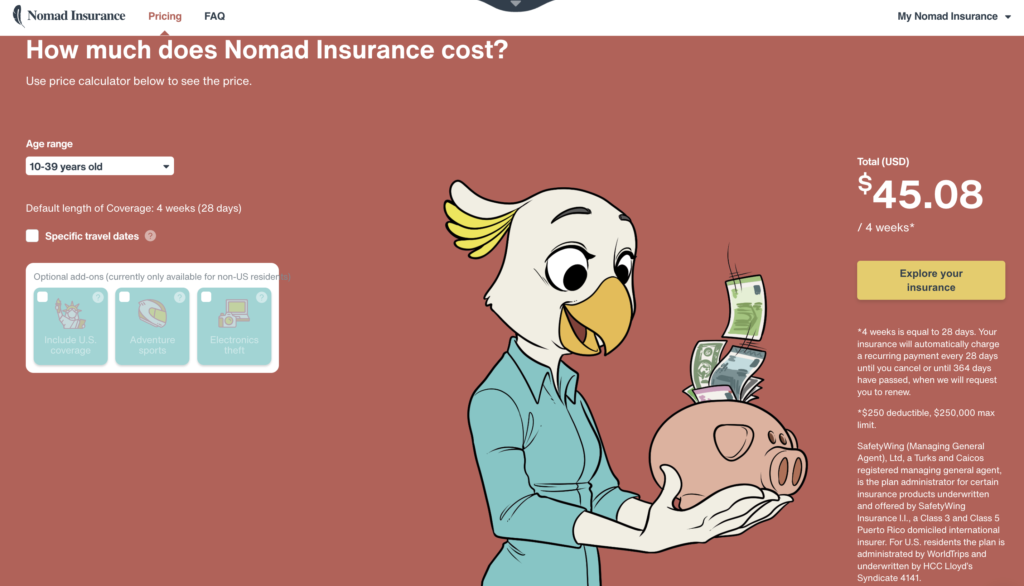

SafetyWing! And we’re super excited to announce that there is now a new upgraded version of the Nomad Insurance that we have been using for the past 3 years!

This new version 2.0 is taking travel safety to a whole new level. From a turbocharged claims process to safeguarding your gadgets and even letting you go wild with adventure sports, Nomad Insurance just got better!

Improvements / Add Ons on the New Nomad Insurance:

- Fast Claims: The claims form is now as straightforward as ordering your favourite coffee (or tea, if you’re like Isa), and the best part? Turnaround time is now a speedy 7-10 business days.

- Electronics Theft Add-On: Tech Gear is normally not cheap stuff! Having travelled through various countries ourselves, we understand that feeling of not being entirely at ease at times. That’s why, when it comes to theft, Nomad Insurance steps up to provide an extra layer of reassurance. Up to $3,000 per active insurance period (max 364 days), up to $1,000 per electronic. Up to $6,000 in your lifetime (lifetime max). Available for those epic trips lasting 28 days or more, this add-on is like a superhero cape for your electronics.

- Adventure Sports Coverage Add-On: Calling all thrill-seekers! There are a lot of sport activities already included as a standard however, now you can quad bike, scuba dive, and even try your hand at martial arts without breaking a sweat about insurance. Check out the FAQ for the full list of covered sports, because, let’s face it, regular insurance doesn’t always get our kind of crazy. With Nomad Insurance, you can embrace the wild side of travel.

Disclaimer: “If you are a US resident, please be aware that this product is currently unavailable. However, SafetyWing will anticipate its availability in the coming months.”

Why should you choose SafetyWing?

Cover for most Travellers

$250,000 max limit cover. ( $250 deductible however, in some situations there is no deductible for ie Pain relieving emergency dental treatment, Emergency eye exam, Visit from a family member in relation to serious illness or injury when hospitalised or about to be hospitalised,.. )

Continuous Coverage Across Borders

Nomad Insurance understands the nomadic spirit. You have the freedom to enjoy continuous coverage, allowing you to traverse multiple countries without the hassle of obtaining new policies at every border. Stay agile, and explore diverse destinations. With Nomad Insurance you can sign up either before your departure or at any stage throughout your travels abroad.

Children Included

Nomad Insurance welcomes young adventurers, offering coverage for up to 2 children under 10 per policy (1 per adult) at no extra cost. To ensure your family’s journey is as flexible and worry-free as possible. Travel with peace of mind, knowing that Nomad Insurance is there to support your family’s global adventures.

Online Chat

Online chat support is available around the clock, ready to address any inquiries you may have. Experience the convenience of real-time assistance – ask questions, seek clarification, or simply chat about your travel concerns. Plus, for your peace of mind, the team will send you a transcript of the chat conversations, so you have a record of the information and guidance you receive.

Home Visits

Home country visits are included in the coverage. You’re eligible for brief visits back home, lasting up to 30 days for every 3 months spent abroad (15 days for US residents).

Lost Luggage

In the event of your luggage being lost during your flight or cruise, you can receive reimbursement for its contents if it remains missing after a 10-day period. ( Up to $3,000 per active insurance period, up to $500 per item. Up to $6,000 in your lifetime (lifetime max). )

What Countries are not Covered?

Nomad Insurance can cover you worldwide outside your home country except for in the following countries:

- Cuba, Iran, North Korea, Syria, Russia & Belarus

- USA (unless you have the US add-on)

- Select regions of Ukraine: Luhansk, Donetsk, Crimea.

As ambassadors for SafetyWing, we’re pumped to see how the new Nomad Travel Medical Insurance is redefining travel safety with its chilled-out claims process, gadget protection, and the green light for your wildest adventures. So, pack your bags and start to hop on the map with peace of mind! 🌍✈️

Check out SafetyWing!

Disclaimers:

– This blog contains affiliate links and sponsored content.

– We strongly encourage all readers to thoroughly read and comprehend the policy documentation, including terms and conditions, before making any decisions. We, as ambassadors, are not responsible for the accuracy or completeness of the information provided, and our perspectives should not be considered as a substitute for professional advice. Our aim is to share our personal opinions and insights as a starting point for your research. Consider our perspective as a friendly conversation rather than an exhaustive guide. Safe travels! 🙂

Harsh Truths About Long Term Travel

You May Also Like

Bali Belly or More Serious? [Learn From our Travel Experience]

June 30, 2024

Harsh Truths About Long Term Travel

September 18, 2023